The key to facing the energy transition is Scope 3

As financial institutions are seeking to understand the underlying risks and opportunities posed by the low-carbon transition, investment strategies have commonly integrated “Scope 1” emissions, i.e., direct emissions from activities, and “Scope 2” emissions, i.e. indirect emissions from the production of electricity, heat, and steam purchased. In contrast, Scope 3 emissions stemming from the entire value chain (from freight, purchase of raw materials to the use of sold products), have not yet been factored in most low-carbon investment strategies. However, when a company’s carbon footprint excludes Scope 3, it does not allow to properly identify risks and opportunities. With the growing policymakers’ interest for its disclosure and the recent ExxonMobil and Shell cases making the headlines, the integration of Scope 3 is not a “why” question for investors anymore, but rather a “when”.

If Scope 3 emissionshave gained such attention, it is partly due to its massive downstream impact in the Automotive and the Oil & Gas industries. In the Automotive sector, Scope 3 emissions have a considerable influence, as it accounts for 95% of the total induced emissions. In the Oil & Gas industry, Scope 3 alone represents 85% of emissions [1] of the industry. Shell, for instance, has 90% of its emissions stemming from its supply chain and the use of its products.

If investors are willing to gain a holistic picture of a company’s carbon footprint, have a credible impact in the fight against climate change, and properly identify the risks that can arise all along the value chain, leaving Scope 3 emissions aside would mean missing out most of the energy transition case. As the study [2] on consistency corporate carbon emissions data notes, it is “only based on the entire life-cycle emissions, [that] investors can capture the full carbon performance and climate responsibility of an individual asset or investment”.

Beyond investors’ willingness to address climate change, Scope 3 adoption could prevent from severe financial impacts caused by stranded assets. Stranded assets are investments that may suffer unanticipated write-downs, devaluations, or conversions to liabilities. Environmental risk factors that could lead to asset impairment include environmental changes (e.g., natural disasters, global warming), heavier regulation (e.g., move to ban diesel cars in Europe, carbon pricing, carbon bubble), technological advances (e.g., increased cost effectiveness of solar panels or wind farms), or changing social norms (e.g., fossil fuel divestment campaigns, consumer behavior). With the integration of value chain emissions (Scope 3) in investment decision making, investors are taking a forward-thinking approach towards the risks of stranded assets, thus avoiding heavy consequences on financial performances.

One could also argue that there is a possible fiduciary risk when not integrating Scope 3. Indeed, ignoring (the largest) part of a company’s emissions means to deliberately decide not to assess the full consequences of climate risks. As a result, not considering Scope 3 emissions in an investment decision is to turn a blind eye to potential financial outcomes, failing to adequately assess the entire spectrum of risks investors are exposed to.

Scope 3 emissions: Complex to measure, impossible to ignore

Although a company is not directly responsible for these indirect emissions per se, it relies on the activities triggering these emissions. If some emissions belonging to the value chain become constrained, it will definitely hinder the operations of the company. Symmetrically, through engaging with suppliers and clients, the company can leverage a positive influence towards the reduction of their own emissions, that will in turn lower the transition risk for the global society. In addition to being the largest component in the GHG emissions bill, Scope 3 emissions reflect how closely intertwined the actors are together.

Looking at the graph above [3], it is striking that Scope 3 emissions from Financial Institutions (banks, insurers, asset managers, holdings, etc.) make up most of their overall climate impact. Indeed, their Scope 3 emissions embed the Scope 1&2 and Scope 3 emissions from their portfolio. It gives a clear view that institutions have a direct responsibility towards their financed emissions.

As to accurately calculate the Scope 3 within each sector, Carbon4 Finance data are based on bottom-up analyses, and on physical flows (e.g., number of barrels of oil produced for an oil company) [4]. In the Oil and Gas sector for instance, our team calculates Scope 3 downstream emissions from the combustion of sold products –barrels of oil, or cubic meters of gas. This equips investors with a credible tool to identify high stakes sectors in which supply chain GHG emissions cannot be ignored.

Recognizing “real” climate leaders

Another key reason for adopting the widespread integration of Scope 3 in investment decisions is to help identify risks and opportunities within each sector individually. As value chain emissions adequately reflect the intertwined links of a company with its environment, it can stand as a lever for investors to further embed climate change mitigation in their investment strategy.

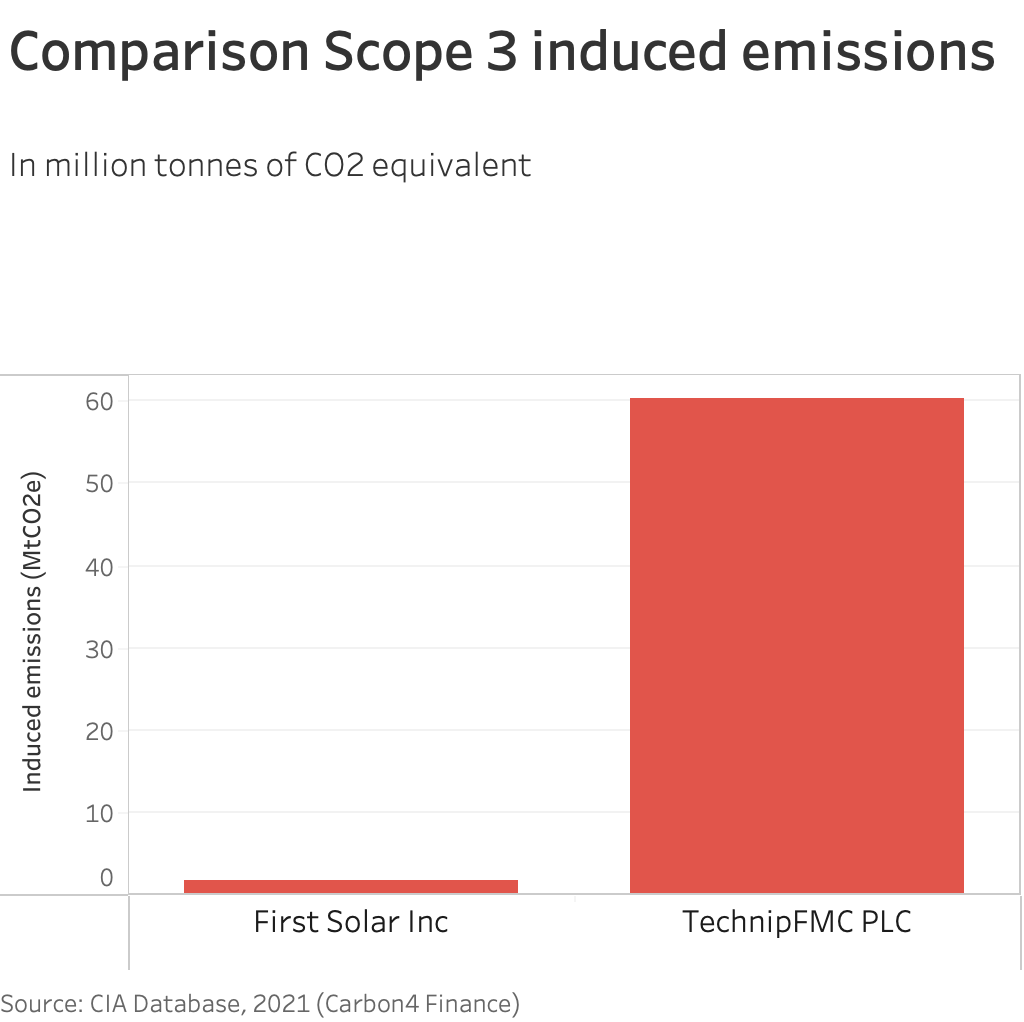

The example of the Energy Equipment sector, as a high contributor to the energy transition, illustrates the value of Scope 3 emissions for investors. TechnipFMC (based in UK) and First Solar Inc (based in the US) are both energy equipment manufacturers, supplying equipment to the Oil & Gas, Electricity Generation and Electricity Transmission & Distribution and Storage industries. While the former offers a portfolio of solutions for the production and transformation of hydrocarbons, the latter provides PV solar energy solutions.

When comparing Scope 1&2 emissions, a traditional investor sticking to these two scopes (and only considering carbon credentials), would have a rather similar investment approach for both companies.

Looking at the whole value chain of the two manufacturers, the overall carbon performances completely differ. While TechnipFMC Scope 3 downstream emissions mainly result from the combustion of oil and gas extracted and refined using the company’s products, most of First Solar Scope 3 emissions are limited to the upstream emissions associated with the purchase of raw materials needed to manufacture solar panels. TechnipFMC Scope 3 emissions amount to more than 99% of its total induced emissions, while First Solar Scope 3 emissions are 30 times lower and account for 70% of its total induced emissions.

This simple case study shows that the traditional focus on Scope 1&2 emissions leads to misleading impact and risk assessments. And this is one of many examples, with similar comparisons existing in the Automotive, aeronautical, or even Agrobusiness sectors. Our platform displays insights over thousands of companies’ carbon performances as we provide Scope 3 emissions data most material to each company’s business.

Achieving global net zero with Scope 3 emissions reduction targets

As mentioned in the Net Zero Initiative Report [5], to contribute to global emissions reduction, Scope 1&2 emissions reduction target alone does not demonstrate a company’s level of understanding of the challenges in the transition to a decarbonized economy. As in most sectors the largest sources of emissions on which an activity depends lie in upstream and downstream Scope 3 emissions, companies should address this by setting ambitious reduction targets across their value chain. As a global response to the climate change crisis is more than necessary, setting Scope 3-related targets are determinant to shift to a low carbon economy, and lower the risk of being out of business should a constraint happen upstream or downstream.

Although the Scope 3 is not yet a broadly integrated criteria, its adoption or inclusion by investors demonstrate their understanding over the risks faced by companies with increasing public scrutiny and rising carbon prices. Not only does it allow to assess the risks, but it also pinpoints the opportunities which arise in the low-carbon transition. Companies with lower Scope 1, 2 and 3 emissions, and with ambitious direct and indirect emissions reduction target, will be considered as real climate leaders.

Scope 3 emissions, in practice

Our clients provided feedback on the use of Scope 3 emissions in their sustainable investment strategy.

David CZUPRYNA, Head of ESG Development at Candriam

“There is a growing realisation amongst investors that, in order to measure a company’s impact on climate, we need to look at its entire value chain and not just the way it operates. Candriam’s ESG analysis already incorporates Scope 3 data in sectors where such data is the most decisive. However, the number of companies providing systematic and comprehensive Scope 3 data is still just a fraction of those reporting on their Scope 1 & 2. Getting companies to fully disclose Scope 3 would enable investors to also integrate them in their reporting, as will become mandatory in the EU under SFDR level 2 for article 8 & 9 financial products.

Systematic disclose of robust Scope 3 data will provide us, investors, with the breadth and depth of data to fully and genuinely integrate climate risks and opportunities within our models.”

Ladislas SMIA, Head of Sustainability Research at Mirova

“The financial sector needs climate data to understand the consequences of climate change on financial performance and to allocate capital towards companies and projects with positive impacts. In both cases, only data that takes into account both positive and negative impacts over the entire life cycle can properly capture the links between the economy and climate. This data exists today. Investors must seize it, to report on their climate performance of course, but above all to integrate it into their investment process.”